In any job search, you have to sift through several postings and identify the roles that match your profile and aspirations. When you are interested in entering a specific field, you may want to know about the lucrative career opportunities in that particular domain. In this article, we would cover the highest paying finance jobs in India.

A specialization in financial management can get you some of the highest salary finance jobs in India entail. Here are the broad categories where you can find employment:

- Accounting

- Investment

- Lending

- Fintech

- Advisory services

- Corporate finance

With this perspective, let us look at some well-paid job titles and understand their work requirements. We have also provided a ballpark figure of the annual compensation associated with every role, as reported by Payscale.

Role of the Finance Sector in the Country’s Economy

Throughout my extensive career in the financial sector, I’ve witnessed the profound impact it has on a country’s economy. It truly serves as the lifeblood, facilitating economic activities and fostering growth. Finance institutions, including banks and stock markets, are instrumental in mobilizing and allocating capital, supporting businesses and individuals with essential financial services, investments, and loans, thus promoting entrepreneurship and wealth generation.

Efficient financial markets play a pivotal role in maintaining economic stability and attracting investments. The sector’s robust risk management strategies are crucial safeguards against economic downturns. In essence, the finance sector in India is the driving force behind economic development, job creation, and overall prosperity, cementing its position as a cornerstone of the nation’s financial well-being.

For professionals seeking the highest paying jobs in finance in India, this sector offers abundant opportunities for growth and success.

What is the demand for finance professionals in India?

Throughout my extensive career in the financial sector, I’ve witnessed the profound impact it has on a country’s economy. It truly serves as the lifeblood, facilitating economic activities and fostering growth. Finance institutions, including banks and stock markets, are instrumental in mobilizing and allocating capital, supporting businesses and individuals with essential financial services, investments, and loans, thus promoting entrepreneurship and wealth generation.

Efficient financial markets play a pivotal role in maintaining economic stability and attracting investments. The sector’s robust risk management strategies are crucial safeguards against economic downturns. In essence, the finance sector in India is the driving force behind economic development, job creation, and overall prosperity, cementing its position as a cornerstone of the nation’s financial well-being.

For professionals seeking the highest paying jobs in finance in India, this sector offers abundant opportunities for growth and success.

Highest paying finance jobs in India

1. Financial Analyst

Job responsibilities: Financial analysts look after company finances, poring over data, and supporting financial management decisions. They also evaluate the possible outcomes of business and investment recommendations. Typically, they are hired in junior and senior capacities in banks, insurance companies, funds, and other financial institutions. Apart from basic financial literacy and accounting skills, these practitioners must possess critical thinking and communication skills.

Average salary of Financial Analyst in India is ₹6,00,000 p.a.

Financial Analyst Salary Based on Location:

| City | Salary |

| Bangalore | ₹6.3 Lakhs |

| Pune | ₹5.2 Lakhs |

| Mumbai | ₹5.8 Lakhs |

| Hyderabad | ₹6.2 Lakhs |

| New Delhi | ₹6.9 Lakhs |

| Chennai | ₹5.8 Lakhs |

| Gurgaon | ₹6.7 Lakhs |

Financial Analyst Salary Based on Experience:

| Experience | Salary |

| 1 Year | ₹4.6 Lakhs |

| 2 Year | ₹5.0 Lakhs |

| 3 Year | ₹5.8 Lakhs |

| 4 Year | ₹6.2 Lakhs |

| 5 Year | ₹6.9 Lakhs |

Financial Analyst Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹5.2 Lakhs |

| Financial Services | ₹5.7 Lakhs |

| Real Estate | ₹4.8 Lakhs |

| Legal | ₹5.1 Lakhs |

| Engineering & Construction | ₹6.4 Lakhs |

Skills required for Financial Analyst

- Accounting

- Interpersonal

- Problem-solving

- Financial literacy

- Problem-solving

A career in finance in india as a Financial Analyst is promising as the individual gets 6.0 lakhs per annum as they get more skilled and experienced.

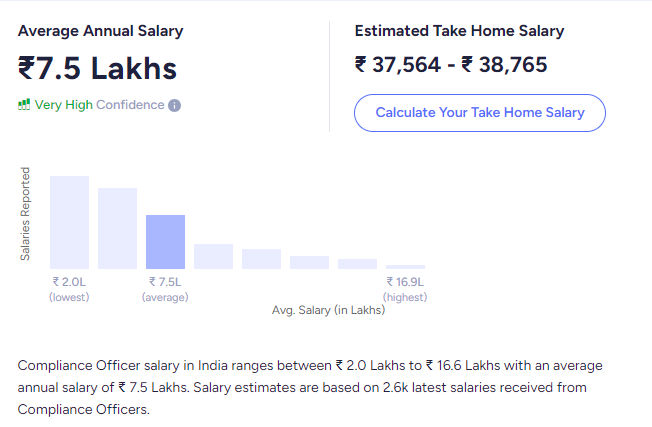

2. Compliance Officer

Job responsibilities: Compliance officers or analysts work in public or private companies, and sometimes in established nonprofit organizations, to ensure that all activities are carried out as per the guidelines set by the governance agencies. Since the long-term financial growth depends upon the established standards and regulations, these professionals play a crucial role in the finance industry. Their work involves aspects of data analysis and reviewing processes and related infrastructure to achieve compliance.

Average salary of Compliance Officer in India is ₹7,40,000 p.a. It is one of the highest-paying finance jobs in India.

Compliance Officer Salary Based on Location:

| City | Salary |

| Bangalore | ₹7.7 Lakhs |

| Pune | ₹8.8 Lakhs |

| Mumbai | ₹8.8 Lakhs |

| Hyderabad | ₹7.3 Lakhs |

| New Delhi | ₹8.4 Lakhs |

| Chennai | ₹5.9 Lakhs |

| Gurgaon | ₹11.4 Lakhs |

Compliance Officer Salary Based on Experience:

| Experience | Salary |

| 1 Year | ₹3.9 Lakhs |

| 2 Year | ₹4.1 Lakhs |

| 3 Year | ₹4.8 Lakhs |

| 4 Year | ₹6.1 Lakhs |

| 5 Year | ₹7.5 Lakhs |

Compliance Officer Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹5.5 Lakhs |

| Financial Services | ₹9.5 Lakhs |

| Real Estate | ₹4.9 Lakhs |

| Legal | ₹3.1 Lakhs |

| Engineering & Construction | ₹7.2 Lakhs |

Skills required for Compliance Officer

- Law

- Data handling

- Entrepreneurial

Find from the World’s top Universities. Earn Masters, Executive PGP, or Advanced Certificate Programs to fast-track your career.

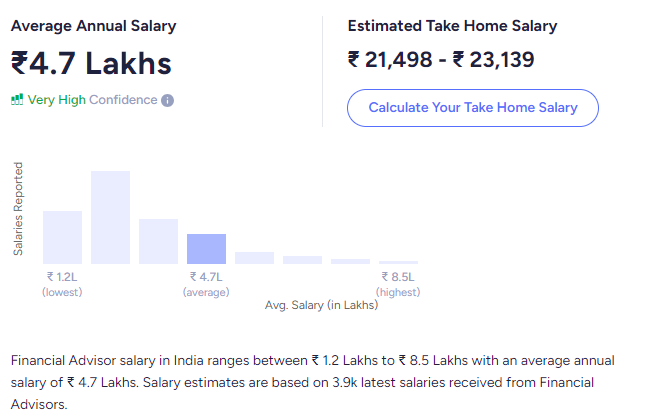

3. Financial Advisor

Job responsibilities: These professionals identify short-term and long-term financial goals for their clients and recommend the most suitable products and services to achieve them. For example, the primary duty of an insurance advisor is to research and suggest insurance offerings and interact with underwritings and risk managers for implementing their various job-related tasks. They are also responsible for providing direction to individual customers regarding the purchase of appropriate life, automobile, housing, and other insurance types.

Average salary of Financial Advisor in India is ₹4,70,000 p.a. This is one of the highest-paying finance jobs.

Financial Advisor Salary Based on Location:

| City | Salary |

| Bangalore | ₹5.0 Lakhs |

| Pune | ₹3.2 Lakhs |

| Mumbai | ₹4.2 Lakhs |

| Hyderabad | ₹3.5 Lakhs |

| New Delhi | ₹4.5 Lakhs |

| Chennai | ₹5.6 Lakhs |

| Gurgaon | ₹5.2 Lakhs |

Financial Advisor Salary Based on Experience:

| Experience | Salary |

| 1 Year | ₹3.1 Lakhs |

| 2 Year | ₹3.5 Lakhs |

| 3 Year | ₹3.7 Lakhs |

| 4 Year | ₹4.8 Lakhs |

| 5 Year | ₹5.6 Lakhs |

Financial Advisor Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹9.7 Lakhs |

| Financial Services | ₹3.4 Lakhs |

| Real Estate | ₹2.6 Lakhs |

| Engineering & Construction | ₹3.7 Lakhs |

Skills required

- Client relationship management

- Business development

- Research

- Wealth Management

- Analytical

- Detail orientation

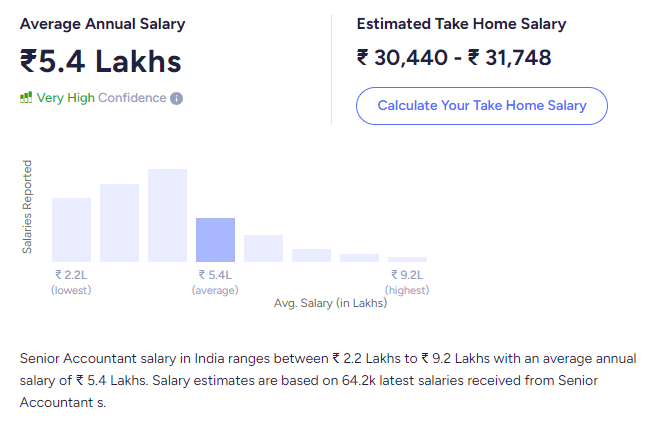

4. Senior Accountant

Job responsibilities: Like any accounting job, this role involves recording entries related to assets, liabilities, revenue, and expenditure of a firm. Senior accountants are at the top of the rung, overseeing and analyzing the financial information and statements, maintaining balances, and resolving discrepancies.

Average salary: INR 5,40,000 p.a.

Senior Accountant Salary Based on Location:

| City | Salary |

| Bangalore | ₹5.7 Lakhs |

| Pune | ₹5.3 Lakhs |

| Mumbai | ₹5.5 Lakhs |

| Hyderabad | ₹5.2 Lakhs |

| New Delhi | ₹5.2 Lakhs |

| Chennai | ₹5.0 Lakhs |

| Gurgaon | ₹5.7 Lakhs |

Senior Accountant Salary Based on Experience:

| Experience | Salary |

| 3 Year | ₹3.6 Lakhs |

| 4 Year | ₹3.9 Lakhs |

| 5 Year | ₹4.2 Lakhs |

| 6 Year | ₹4.6 Lakhs |

| 7 Year | ₹4.8 Lakhs |

Senior Accountant Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹5.4 Lakhs |

| Financial Services | ₹6.1 Lakhs |

| Real Estate | ₹5.1 Lakhs |

| Legal | ₹5.0 Lakhs |

| Engineering & Construction | ₹5.8 Lakhs |

Skills required

- Detail orientation

- Organisational

- Financial literacy

- Collaborative

- Self-starter

5. Loan Officer

Job responsibilities: Loan officers approve, authorize, and process applications for real estate, business, or credit loans. They assess candidates’ financial status or creditworthiness and subsequently interview them. Setting up plans for debt payment and evaluating applicable metrics and ratios are some of their other duties. You can work as a loan officer in a mortgage company, a commercial bank, or a credit union.

Average salary of Loan Officer in India is ₹2,70,000 p.a. (starting). It is one of the high-paying finance jobs where the salary keeps increasing with time and experience.

Loan Officer Salary Based on Location:

| City | Salary |

| Bangalore | ₹2.8 Lakhs |

| Pune | ₹2.8 Lakhs |

| Mumbai | ₹2.8 Lakhs |

| Hyderabad | ₹2.7 Lakhs |

| New Delhi | ₹2.6 Lakhs |

| Chennai | ₹2.7 Lakhs |

| Gurgaon | ₹3.0 Lakhs |

Loan Officer Salary Based on Experience:

| Experience | Salary |

| 3 Year | ₹2.7 Lakhs |

| 4 Year | ₹2.8 Lakhs |

| 5 Year | ₹3.0 Lakhs |

| 6 Year | ₹3.3 Lakhs |

Loan Officer Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹2.8 Lakhs |

| Financial Services | ₹2.8 Lakhs |

| Real Estate | ₹2.3 Lakhs |

| Engineering & Construction | ₹2.3 Lakhs |

Skills required

- Experience in the field of loans

- Financial understanding

- Understanding of direct and indirect lending

- Customer satisfaction

6. Information Technology Auditor

Job responsibilities: IT auditors work in government departments or private companies to attain synchrony between the technology infrastructure and enterprise needs. They also look after IT compliance and digital security to enable smooth functioning of all organizational processes.

So, the audit review procedures can extend to software programs, computer networks, communication systems, and security setup. This job necessitates an adequate understanding of physical IT controls within the company and requires knowledge about the business operations and financial practices.

Average salary of Information Technology Auditor in India is ₹9,60,000 p.a. It is one of the highest-paid finance jobs in India.

Information Technology Auditor Salary Based on Location:

| City | Salary |

| Bangalore | ₹9.5 Lakhs |

| Pune | ₹9.2 Lakhs |

| Mumbai | ₹12.1 Lakhs |

| Hyderabad | ₹8.6 Lakhs |

| New Delhi | ₹8.5 Lakhs |

| Chennai | ₹8.8 Lakhs |

| Gurgaon | ₹9.4 Lakhs |

Information Technology Auditor Salary Based on Experience:

| Experience | Salary |

| 1 Year | ₹5.8 Lakhs |

| 2 Year | ₹6.6 Lakhs |

| 3 Year | ₹7.1 Lakhs |

| 4 Year | ₹8.1 Lakhs |

| 5 Year | ₹9.8 Lakhs |

Information Technology Auditor Salary Based on Industry:

| Industry |

| IT Services & Consulting |

| Financial Services |

| Software Product |

| Engineering & Construction |

Skills required

- Knowledge of technical applications

- System Security Knowledge

- Knowledge of auditing

7. Financial Software Developer

Job responsibilities: As the finance industry embraces technology and the internet, the demand for software developers has experienced a sharp rise. These employees design, develop, test, and maintain software and other programs that align with the company and end-users’ needs. Fintech is an emerging space for software developers as it envisions efficient delivery of financial services and associated activities. Some examples include mobile payments, stock trading applications, budgeting apps, and cryptocurrencies.

Average salary: INR 7,06,919 p.a. It is one of the in-demand finance careers in India.

Skills required

- Computer skills

- Programming languages

- Self-development skills

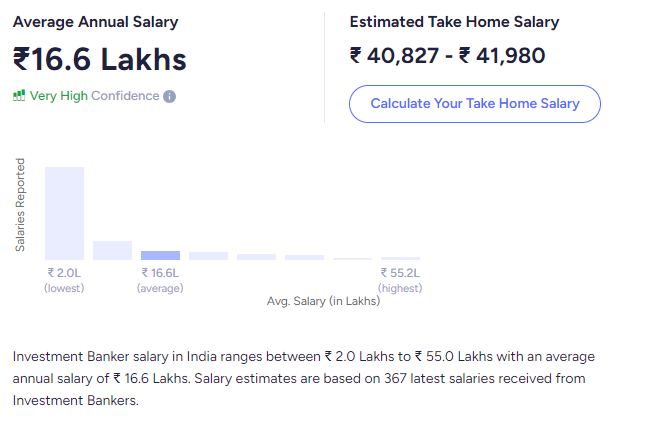

8. Investment Banker

Job responsibilities: As an investment banker, you are responsible for managing an investing entity’s investment portfolio. In other words, you keep track of the money invested by your client in different businesses to optimize the return and achieve the predetermined financial goals.

Investment bankers handle stock and bond issues and also arrange for debt financing. Additionally, they are well-versed in managing merger and acquisition deals that bring in the most financial gains for investment banks. Investment banking is among the highest paying finance jobs in India, where candidates with significant experience can earn a total remuneration of Rs 16.5 lakh a year.

Average investment banker salary in India is ₹16,60,000 p.a.

Investment Banker Auditor Salary Based on Location:

| City | Salary |

| Bangalore | ₹9.7 Lakhs |

| Pune | ₹14.7 Lakhs |

| Mumbai | ₹21.3 Lakhs |

| Hyderabad | ₹4.5 Lakhs |

| New Delhi | ₹9.4 Lakhs |

| Chennai | ₹3.8 Lakhs |

| Gurgaon | ₹12.6 Lakhs |

Investment Banker Auditor Salary Based on Experience:

| Experience | Salary |

| 2 Year | ₹8 Lakhs |

| 3 Year | ₹10.6 Lakhs |

| 4 Year | ₹13.4 Lakhs |

| 5 Year | ₹22.9 Lakhs |

Investment Banker Auditor Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹4.2 Lakhs |

| Financial Services | ₹23.5 Lakhs |

| Management Consulting | ₹6.3 Lakhs |

Skills required

- Communication

- Self-starter

- Research and analysis

- Presentation skills

- Securities

- Mergers and acquisitions

9. Hedge Fund Manager

Job responsibilities: High net worth individuals who are enthusiastic about investing often hire hedge fund managers to monitor markets and maximize their earnings. The job functions are similar to that of investment banking, except for the higher risk-reward portfolios of hedge fund managers.

Investors pool their capital to make investments, and the fund manager protects them. Due to the intense working hours and technical nature, this career comes with a high entry-level salary of Rs 7.5 lakh a year.

Average salary: INR 24,00,000 p.a. It is one of the highest-paying jobs in finance in India.

Skills required

- Investment knowledge

- Finance understanding

- Financial Modelling

- Quantitative

- Legal

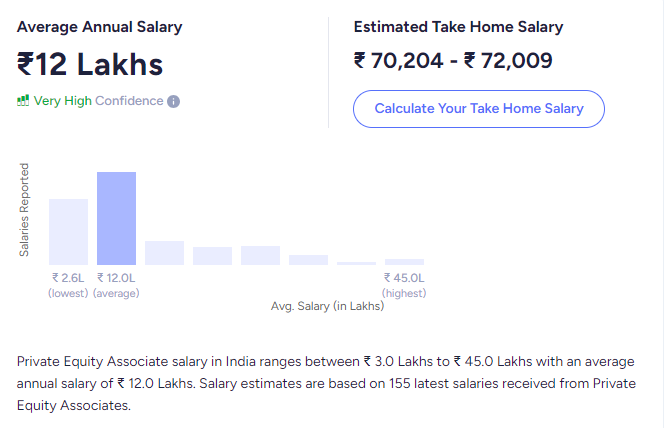

10. Private Equity Associate

Job responsibilities: Private equity and venture capital funds provide finance to early-stage ventures and growing businesses. This funding comes in exchange for profit participation or equity stake in the investee company. Like hedge fund managers, private equity associates liaise with the investor firms/individuals and apply their capital to business ventures having growth potential.

Average salary of Private Equity Associate in India is ₹12,00,000 p.a.

Private Equity Associate Salary Based on Location:

| City | Salary |

| Bangalore | ₹20.3 Lakhs |

| Pune | ₹9.6 Lakhs |

| Mumbai | ₹23.8 Lakhs |

| Hyderabad | ₹9.4 Lakhs |

| New Delhi | ₹8.7 Lakhs |

| Chennai | ₹4.4 Lakhs |

| Gurgaon | ₹8.2 Lakhs |

Private Equity Associate Salary Based on Experience:

| Experience | Salary |

| 1 Year | ₹7.4 Lakhs |

| 2 Year | ₹16 Lakhs |

| 4 Year | ₹17 Lakhs |

| 5 Year | ₹22.8 Lakhs |

| 6 Year | ₹40.7 Lakhs |

Private Equity Associate Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹8.1 Lakhs |

| Financial Services | ₹12 Lakhs |

| Management Consulting | ₹14.4 Lakhs |

Skills required

- Financial Modelling

- LBO Modelling

- M&A Modelling

- Financial Analysis

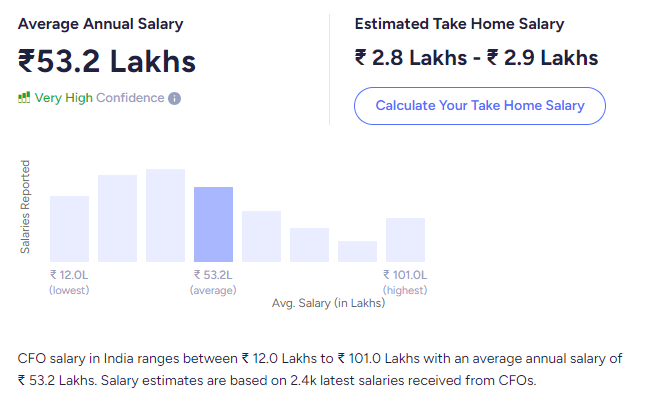

11. Chief Financial Officer

Job responsibilities: The Chief Financial Officer or CFO has the duties of managing a company’s capital structure and cash flow and planning for its future growth. Therefore, the CFO must have in-depth knowledge of accounting and financial modeling, among other skill sets. These executives also oversee the work of analysts, manage financial teams, and make decisions related to costing and technology infrastructure. The CFO title is particularly prominent in the retail and commercial banking sector in India.

Average salary of Chief Financial Officer in India is ₹52,30,000 p.a.

Chief Financial Officer Salary Based on Location:

| City | Salary |

| Bangalore | ₹71.4 Lakhs |

| Pune | ₹53.5 Lakhs |

| Mumbai | ₹60.1 Lakhs |

| Hyderabad | ₹44 Lakhs |

| New Delhi | ₹46 Lakhs |

| Chennai | ₹77 Lakhs |

| Gurgaon | ₹48.7 Lakhs |

Chief Financial Officer Salary Based on Experience:

| Experience | Salary |

| 9 Year | ₹21.7 Lakhs |

| 10 Year | ₹29.9 Lakhs |

| 11 Year | ₹30.5 Lakhs |

| 12 Year | ₹33.2 Lakhs |

| 13 Year | ₹41.5 Lakhs |

Chief Financial Officer Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹90.5 Lakhs |

| Financial Services | ₹34.7 Lakhs |

| Real Estate | ₹49.9 Lakhs |

| Engineering & Construction | ₹48.7 Lakhs |

Skills required

- Deep financial understanding

- Problem- solving skills

- Decision-making

- People Management

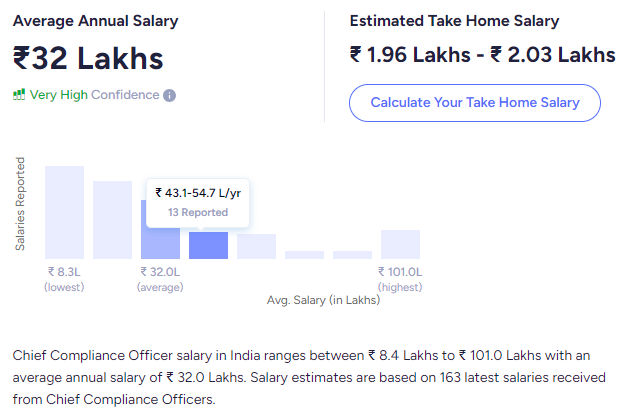

12. Chief Compliance Officer

Job responsibilities: As the title suggests, this job is a top-notch role in compliance monitoring and policy management. CCOs apply their education and experience to eliminate non-compliance fees for the firms. Before landing this coveted spot, they may work as analysts, managing directors, and other positions to master the ropes and legal standards.

Average salary of Chief Compliance Officer in India is ₹32,00,000 p.a.

Chief Compliance Officer Salary Based on Location:

| City | Salary |

| Bangalore | ₹38.7 Lakhs |

| Pune | ₹15.5 Lakhs |

| Mumbai | ₹40 Lakhs |

| Hyderabad | ₹24 Lakhs |

| New Delhi | ₹38.5 Lakhs |

| Chennai | ₹40 Lakhs |

| Gurgaon | ₹29.5 Lakhs |

Chief Compliance Officer Salary Based on Experience:

| Experience | Salary |

| 7 Year | ₹12 Lakhs |

| 8 Year | ₹15.8 Lakhs |

| 9 Year | ₹20 Lakhs |

| 10 Year | ₹22 Lakhs |

Chief Compliance Officer Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹25 Lakhs |

| Financial Services | ₹40 Lakhs |

Skills required

- Understanding of law

- Entrepreneurial

- Analytical

- Data handling

- Communication

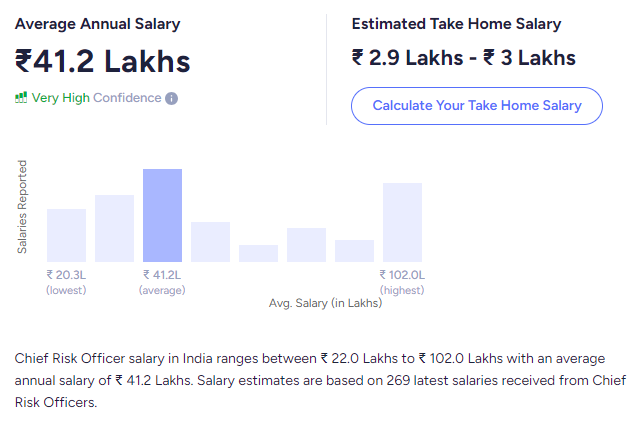

13. Chief Risk Officer

Job responsibilities: Chief Risk Officers or CROs work in financial firms, looking out for any events that may threaten the company’s profitability or financial solvency. They monitor investments, interact with the CCO, and assess risks by applying their superior analytical and problem-solving skills. This is one of the best paying jobs in finance in India.

Average salary of Chief Risk Officer in India is ₹41,20,000.

Chief Risk Officer Salary Based on Location:

| City | Salary |

| Bangalore | ₹68.5 Lakhs |

| Pune | ₹16.1 Lakhs |

| Mumbai | ₹42.1 Lakhs |

| Hyderabad | ₹47.5 Lakhs |

| New Delhi | ₹33 Lakhs |

| Chennai | ₹50.5 Lakhs |

| Gurgaon | ₹33 Lakhs |

Chief Risk Officer Salary Based on Experience:

| Experience | Salary |

| 12 Year | ₹33.5 Lakhs |

| 14 Year | ₹41.4 Lakhs |

| 15 Year+ | ₹45.4 Lakhs |

Chief Risk Officer Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹93.5 Lakhs |

| Financial Services | ₹40.7 Lakhs |

| Engineering & Construction | ₹1 Crore |

Skills required

- Leadership

- Relationship building

- Risk Management

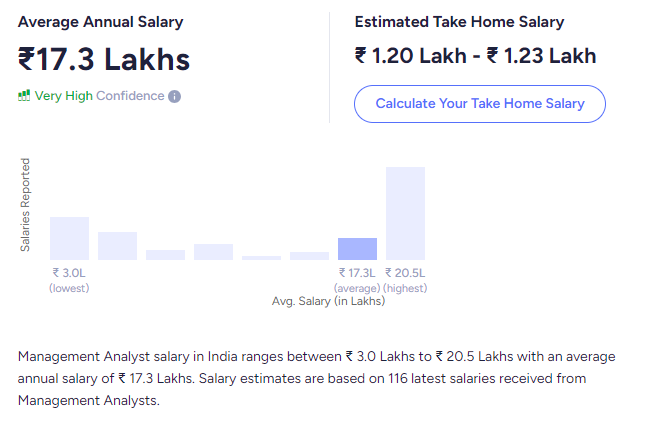

14. Management Analyst

Job responsibilities: Management consultants and analysts work to improve business performance. They examine specific issues and develop solutions to boost efficiency. To work as a management analyst, you should be able to interpret data and information and use your findings to create proposals for the company. Professional certification in business analytics can help you become more job-ready for management analyst positions. Alternatively, you can consider applying for a specialized MBA program.

Average salary of Management Analyst is ₹12,80,000 p.a. (entry level)

Management Analyst Salary Based on Location:

| City | Salary |

| Bangalore | ₹17.2 Lakhs |

| Pune | ₹11 Lakhs |

| Mumbai | ₹18.3 Lakhs |

| Hyderabad | ₹17.9 Lakhs |

| New Delhi | ₹16.6 Lakhs |

Management Analyst Salary Based on Experience:

| Experience | Salary |

| 2 Year | ₹13.7 Lakhs |

| 3 Year | ₹13.9 Lakhs |

| 4 Year | ₹13.4 Lakhs |

(Source)

Management Analyst Salary Based on Industry:

| Industry | Salary |

| IT Services & Consulting | ₹15.1 Lakhs |

| Financial Services | ₹17.9 Lakhs |

Skills required

- Analyst skills

- Communication

- Time Management

- Problem-solving

- Interpersonal

15. Personal Finance Advisor

Job responsibilities: Personal financial advisors provide their services in diverse areas, ranging from life insurance, estate planning, investments, taxes, retirement planning to personal budgeting assistance. You can also start a practice or consulting firm for this purpose. It would be ideal to have a background in accounting or finance, followed by an MBA or MSc. in Finance.

Average salary: INR 4,90,565 p.a.

Skills required

- Excellent communication skills

- Financial literacy

- Ability to explain articulately

- Research

- Analytical

Highest Paying Banking Jobs in India

Jobs in finance sector in India can be very well paid. There are many jobs that you can consider with the correct qualifications. Here is the list of best paying jobs in finance

1. Personal Banker – They assist clients and customers in every detail related to their bank accounts, like opening and managing their accounts and safe deposit boxes.

Average salary – INR 3,84,000 p.a.

2. Bank Auditor – They review all the financial statements of the client. They can check if the risk management procedures of the bank are effective. They can assist in investigations the report the faults to higher authorities.

Average salary – INR 5,04,000 p.a.

3. Credit Analyst – Whenever an individual or business seeks credit from a bank, a credit analyst analyzes their financial information. They are responsible for checking whether the client is creditworthy or not.

Average salary – INR 6,18,000 p.a.

4. Fund Manager – The role of a fund manager is one of the highest paying banking jobs in India. This job involves extensive research, planning, and implementation of various financial strategies. They are also responsible for buying and selling the best stocks and bonds as well.

Average salary – INR 15,00,000 p.a.

5. Finance Manager – They manage different types of financial tasks and projects. They can prepare financial statements, estimates, budget plans, and risks.

Average salary – INR 10,05,108 p.a.

The Future of Finance in India

It seems like digital is catching the attention of finance leadership every day; use cases for digital are constantly evolving. As digitization transforms how we work, live, and relax, the stimulus often comes from the front end of the business. With the younger generation becoming more active, there is an increasing demand to make the financial sector more agile, friendly, and straightforward, extending diverse jobs in finance sector in India.

Digital finance is the main requirement for the future. Digital revolutions and innovations are what the financial sector has been witnessing for the last couple of years since finance is the fastest growing sector in all aspects of the economy.

In a concise period of time, fintech has totally transformed the way people make monetary transactions. In the world of digitization, India is bringing the format of ‘cashless’ alive. Business owners in India are bringing in customers from all across the world based on this digitization. Finance Minister of India, Nirmala Sitaraman, stated in an interview that the finance industry of India will surge from $50-60 billion in 2020 to $150 billion in 2025.

All the latest financial models for the country include the latest technologies like Artificial Intelligence (AI), Internet of Things (IoT), Cloud Computing, and Machine Learning (ML). This has also managed to gain the customers’ trust and has the potential to transform and develop new financial services in India.

Fintech has been gaining popularity worldwide because of its integration of technology and financial services and has attracted a considerable amount of investment from different verticals of business, resulting in better business performance and greater research and innovation collaboration.

Here is how the different technologies have helped the industry evolve –

- Machine Learning and Artificial Intelligence – AI and machine learning solutions can transform regulatory compliance, financial fraud, and cybercrime. The fintech industry can also tailor products and services to the needs of each consumer by utilizing customer data as a means of personalization.

- Internet of Things – With IoT, finance companies can gather and transfer data more efficiently, saving them time and money. Information is collected and processed efficiently, allowing core processes to be automated. Financial institutions can also benefit significantly from IoT by improving customer service.

- Cloud Computing – Online resources, applications, or storage are provided through cloud computing as an on-demand service. As opposed to storing and processing data locally, financial institutions can store and process data remotely.

- Blockchain – Digital lending is now safer, thanks to blockchain technology. As a distributed, public, decentralized ledger, transactions are recorded across many computers to prevent tampering. Fintech institutions will significantly improve their operational efficiency through blockchain as the focus shifts from payments to securities and trade finance.

The Way Forward

In a growing economy like India, BFSI (Banking, Financial Services, and Insurance) is a critical section contributing close to 6 percent of the annual GDP. By 2022, the BFSI sector would require an additional 1.6 million skilled workforce, as estimated by the National Skill Development Corporation (NSDC).

If you are looking to upskill, you can consider taking up an advanced certification course or a PG diploma that meets your learning goals. It would be best to select a program after going through its syllabus, duration, financial commitment, and accreditation status.

You can go for certification programs like upGrad’s Job-ready Program in Financial Modelling & Analysis. It aims to familiarize you with the fundamentals of Accounting Statements, Risk Management, Working Capital Management, Marketing, HR, Economics, Project Evaluation, etc. Besides the in-class content, entrepreneurs and mid-stage career professionals can also gain from industry projects and mentorship sessions.

Moreover, you can enroll while working, devoting about 10-12 hours per week for 20 months. Upon completing the program, you would earn dual credentials from LBS and IMT Ghaziabad.

Future-oriented online courses like MBA in Digital Finance and Banking can help make your candidature more attractive for existing and new job positions in the BFSI sector. The curriculum aims to equip you with the knowledge of fintech ecosystems, applications of AI in business, blockchain and cryptocurrencies, financial valuation, data visualization, fraud and risk analytics, and business leadership.

This course is available on upGrad’s platform and accredited by the Jindal Global Business School. JGBS alumni have been employed in companies like Amazon, Deloitte, Barclays, ICICI Bank, Yes Bank, Philips, GSK, ITC, Dabur, and many other corporate giants.

This brings us to the end of this article on the highest paying finance jobs in India. We identified specific positions, described their job specifications, and also detailed the highest salary finance jobs in India can get you. The current landscape of the Indian financial sector is highly competitive. This information would not only guide you while job-hunting but also streamline your preparation in reaching your desired career path.